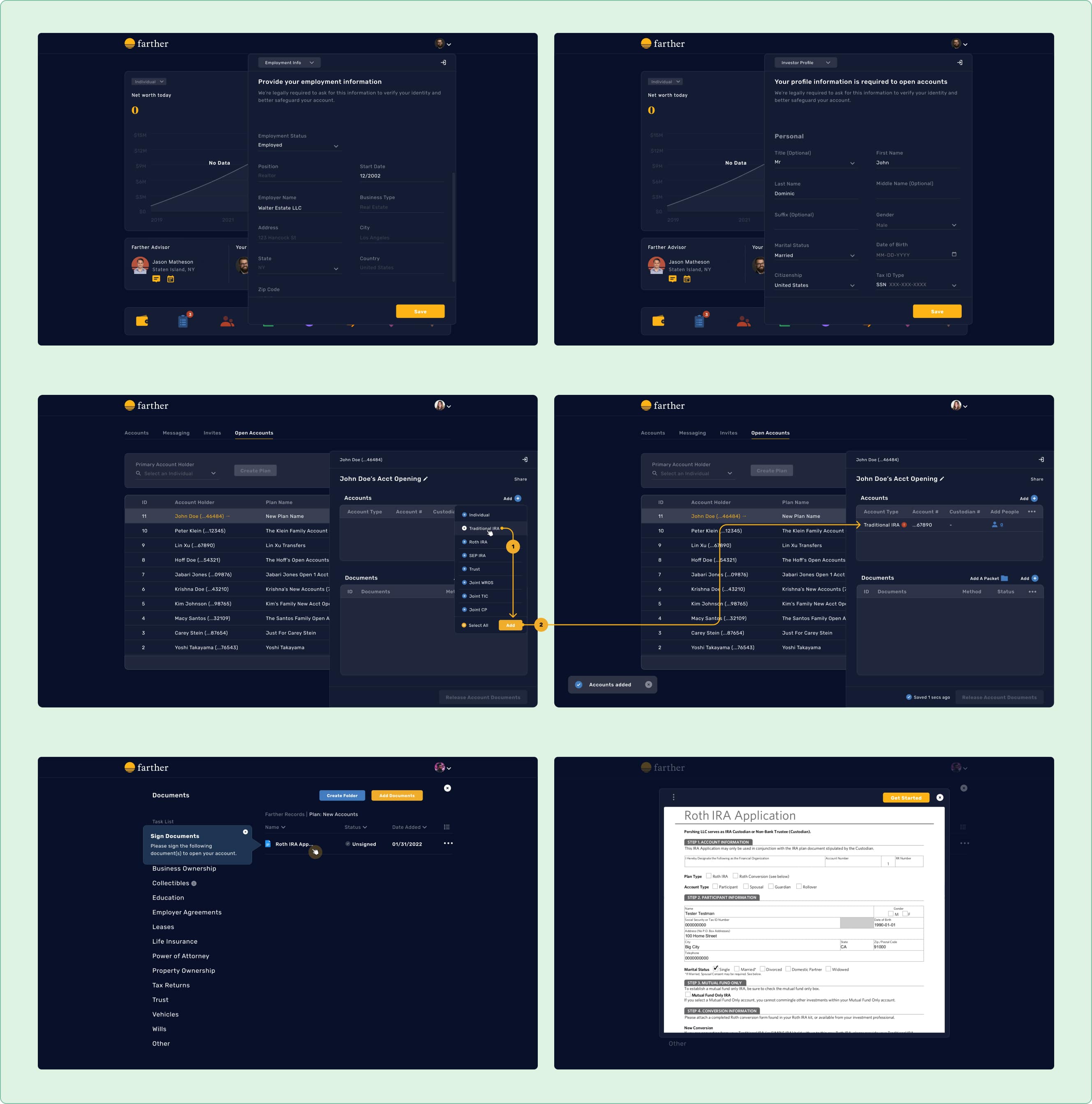

Designed the end-to-end account opening experience for wealth management, improving workflows for Advisors, the Client Experience team, and Clients. As the lead designer, I worked with the CTO, 2 pms, 4 engineers, the Client Experience team for 3 weeks through an iterative process.

Problem

Onboarding new advisors and their clients every week is a very manual process, creating a poor client experience and an increase in operational risk.

Hypothesis

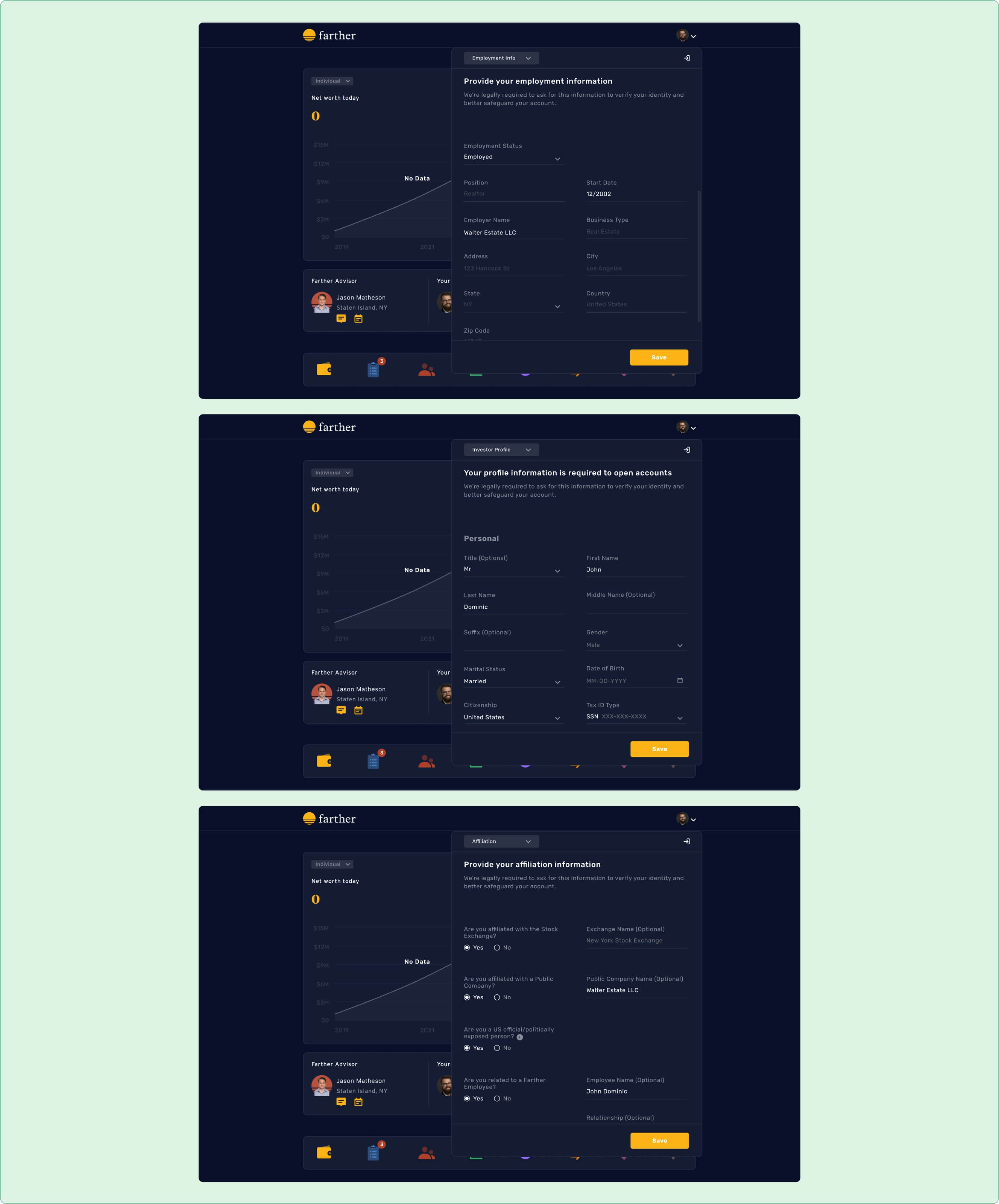

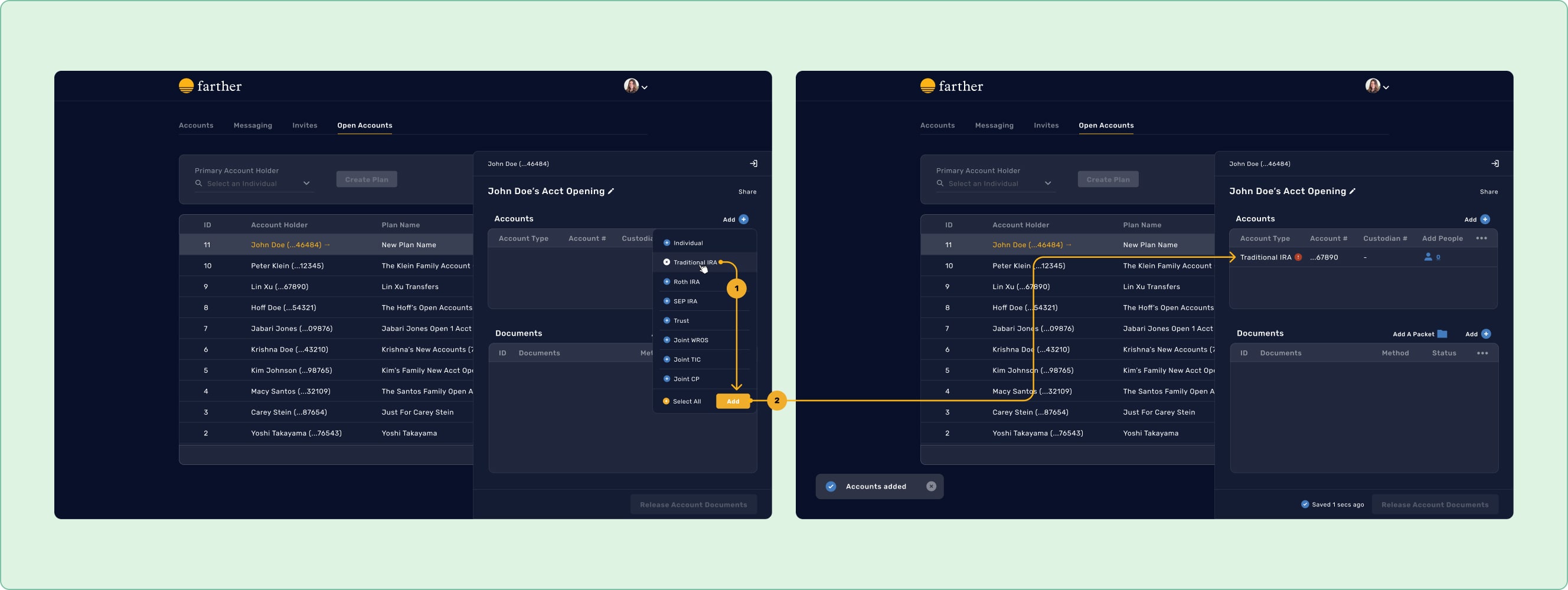

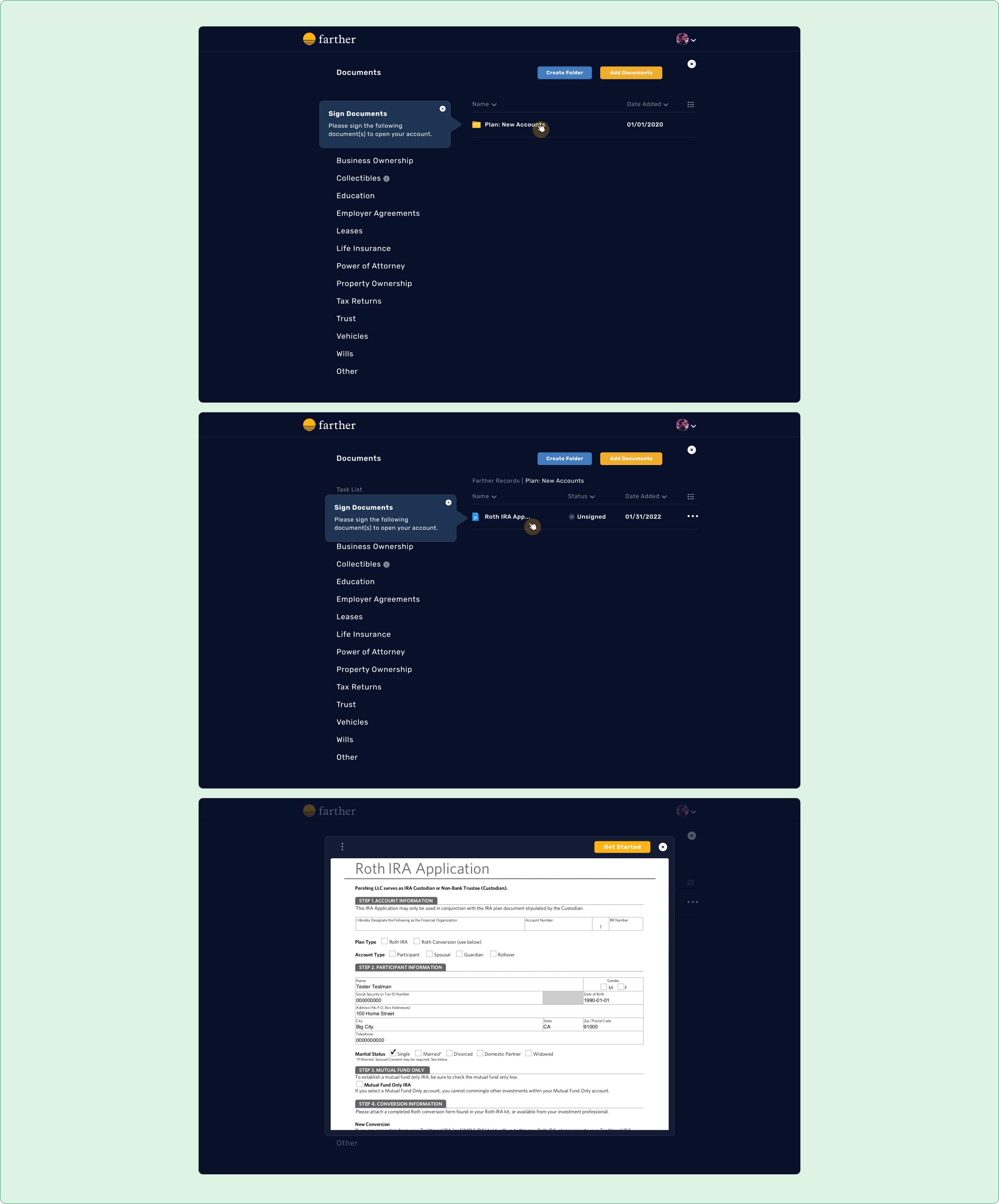

If we digitalize the entire onboarding process, we can automate workflow with digital forms, gather client information only once, use secure e-signature tools, and manage all documents in one central place.

Solution

Designed the end-to-end account opening experience, consolidating client info collection, integrated e-signatures, document upload, and account setup into one centralized flow.

Outcome

Since launching in 2022, AUM has grown from $50M in 2022 to $9B in 2025.